Alright, so Wall Street's patting itself on the back for a decent October. S&P up 2.3%, Dow scraping by with 2.5%, and the Nasdaq, bless its heart, jumped 4.7%. Big deal. We’re supposed to be impressed?

The Usual Suspects

It's always the same story, ain't it? "AI momentum" and "easing trade tensions with China" are getting the credit this time. Give me a break. It’s always something. One minute it’s AI saving the world, the next it’s… well, whatever the hell the latest excuse is.

Tom Lee from Fundstrat is out there flapping his gums about strong earnings, blockchain innovation, and the Fed being all dovish. He says quantitative tightening ends in December. Okay, Tom. Thanks for the hot tip. I am sure that will happen.

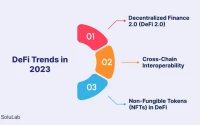

And seriously, "blockchain innovation"? Is that still a thing? Feels like 2017 all over again. Remember when everyone and their grandma was launching an ICO? Now it's "innovation" again? I am not buying it.

Oh, and more than 80% of S&P 500 companies beat expectations. Shocking. Absolutely shocking. Wait, no it isn’t.

November's "Historically Strong" Month

So, now we’re being told November is historically the strongest month for the S&P 500, averaging a 1.8% gain. Data from the Stock Trader’s Almanac, no less. Seriously? You think the market gives a damn about what happened in November last year, or the year before that? Or any year before that? Past performance is not indicative of future results, as they say.

Plus, we got that whole government shutdown mess gumming up the works. Delayed economic data. Can't even get a proper jobs report. How are we supposed to make informed decisions when the government is too busy playing political games to release the damn numbers?

And don't even get me started on the Supreme Court hearing arguments about Trump's tariffs. Still fighting that fight? Seriously?

More than 100 companies reporting earnings this week, including Palantir and AMD. So, what? More hype? More overblown promises? More CEOs patting themselves on the back while the rest of us struggle to pay rent?

Speaking of rent, my landlord just raised mine again. Apparently, "market conditions" justify a 15% increase. I should invest in real estate. Then again, maybe I'm the crazy one here.

The Calm Before the Storm?

Stock futures are barely budging. S&P 500 futures up a measly 0.17%. Nasdaq-100 futures up 0.26%. Dow up 49 points, or 0.1%. Woo-hoo. Let's throw a parade. It's like watching paint dry. All this… nothingness. Stock futures are little changed to start November trading: Live updates - CNBC.

Is this the calm before the storm? Are we all just sleepwalking towards another crash? Or is this the new normal? Just a slow, agonizing grind higher, punctuated by the occasional flash crash to keep us on our toes?

I don't know. And frankly, I'm not sure anyone does.

So, What's the Catch?

Look, October was fine. But let's not pretend this is some kind of roaring bull market. This feels like a house of cards built on hopium and wishful thinking. Enjoy the ride while it lasts, but don't get too attached. It could all come crashing down tomorrow.